Select Direct Portfolio

Select Direct Portfolio

A discretionary portfolio of Direct Plans of Mutual Funds curated with a fundamentally driven process honed over many market cycles.

Premise

An endeavor to provide our investors a better way to invest in Mutual Funds through a Product that is a Progression of the Traditional Wealth Management Practice.

We found that outperformance of mutual funds is dependent on Stellar Returns by Mid & Small Cap Companies. However, performance of these Market Segments is not Consistent and depends on the Valuations at Investing and Exit.

This product allows for Efficient Implementation of our Market Views and enables our investors to benefit from Direct Plans of Mutual Funds.

The Structure

The core of the two-part portfolio will be positioned to benefit from structural growth. The satellite part will be deployed for opportune medium- term investments.

Core (65%)

- Diversified Equity Mutual Funds with Long Term Horizon

Satellite (35%)

- Sector, Commodity Satellite & Cash Calls

- Short to Medium term

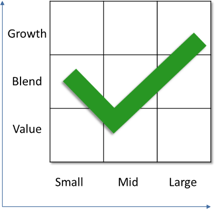

The underlying Investment Portfolio may be positioned across Market Cap categories and investment styles. This portfolio positioning is guided by a Synthesis of Fundamental, Behavioural, Quantitative & Technical Research.

What it is

- An Equity Mutual Fund Portfolio.

- Risk: Equity-like.

- Diversified Portfolio.

- Cost benefit of Direct Plan vis a vis Regular Plan.

- Investment Horizon – Long Term.

What it is Not

- Portfolio of Equity Shares.

- Asset Allocation or Hybrid Category Product.

- Equivalent to Equity Share PMS Products.

- Low Volatility Product.

- Assured Return Product.

Investor Relationship Officer – PMS: iro@wealthmanagers.co.in

Compliance Officer – PMS: compliance@wealthmanagers.co.in