Focused leadership Portfolio

Focused leadership Portfolio

Concentrated portfolio of Current and Emerging leaders with proven track record

Broad Strategy

- Focused would entail Businesses, Management and the manner in which we would structure the Portfolio. Leadership will reflect company’s positioning within its Core Operating Business.

- Focused

- Focused Businesses – The Core Operating Business should have a Single Risk- Return Characteristics irrespective of its Reporting Segments. We will prefer Simple and Easy to Understand Businesses.

- Focused Management – Focus and Involvement in Business

- Focused Portfolio – Concentration Levels

- Leadership Positioning – It should be either within the Top 3 Players in the Segment (Sales, Profits, Assets or Market cap) or should be an Emerging Leader Challenging the Incumbents.

- Targeting Sales Pool / Profit Pool / Cash Flow Pool / Asset Pool

Business – Focused Leadership

- Simple and Easy to Understand businesses

- Visibility of Cash Flows and Earnings

- Favourable Long Term prospects

- Size of opportunity is significantly larger than current scale of business.

- There should be earnings momentum or it should be visible in a year’s time.

- High Market Share in Core Business

- Businesses will have Favourable Terms of Trade / having “Moat” around themselves.

- Strong and Consistent Financial Traits

Financial Tenets

- Capital Efficiency – Maintaining Reasonable Operating ROCE levels (even during downturns)

- Cash Flow – Positive

- Capital Structure – Reasonable on Debt / Equity as well as High Interest Coverage

- Working Capital – Both Gross and Net Working Capital should be Efficient

Management – Qualitative Assessment

- Rational Capital Allocation Philosophy – Long term Sustainable ROCE?

- Competency – Function of not only Experience and Focus on Domain Expertise. Deviation between Guidance and Actuals important for understanding competency.

- Integrity and Honesty – The Reporting Culture, Compensation Structure and manner of Red Flags important determinants.

- Integrity as well as Dynamism

- Focus and involvement in Business

- Attitude towards Minority Shareholders – e.g. Dividend Policy

Portfolio Characteristics

- The portfolio has an upper cap of 40% in each sector (internal restrictions). Total sectors in the portfolio shall not exceed 7.

- The stock in the portfolio will have minimum 5% & maximum 15% proportion. Normally our buying exposure will be 10% – 12% and let the run-up in the stock reach the higher limits.

- The Core Segment built with 4 years horizon, shall be 65% – 100%.

- We will also look for Opportunities in the 1 – 3 years time frame which shall be 0 – 35% of the portfolio, where we will look for clear triggers in the defined time period for our thesis to play out.

- Typically, portfolio would have 10 – 15 stocks.

- Though we may report performance monthly and quarterly, we shall benchmark the portfolio on yearly basis.

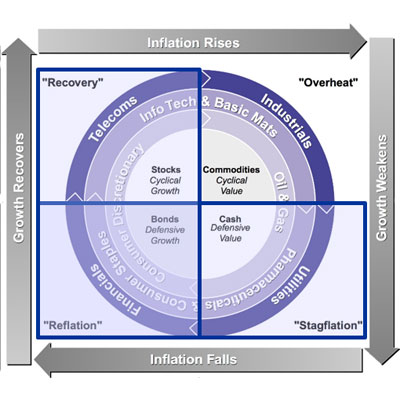

Portfolio Themes

We are looking to play the Reflation and Recovery Stage of Economic Cycle and hence we will have at least 50% from

- Financials

- Consumer Discretionary

- Technology

- Consumer Staples

- Industrials selective stage

Investor Relationship Officer – PMS: iro@wealthmanagers.co.in

Compliance Officer – PMS: compliance@wealthmanagers.co.in